Polkadot Staking Overview

Introduction

The Polkadot blockchain relies on a Nominated Proof-of-Stake consensus. Each blockchain may implement the Proof-of-Stake mechanism in a different way, resulting in differences in the flow of actions from the user to stake their asset and nominate a validator to secure the network on their behalf.

Polkadot has introduced a new set of vocabulary to facilitate the understanding of each specific action needed to achieve staking and earn rewards. You’ll soon be familiar with the terms of bonding and unbonding assets, as well as the concept of proxy to help you earn rewards on the Polkadot blockchain.

The benefits of staking Polkadot are:

-

Best rewards vs market cap

The Polkadot blockchain has reliably been in the Top 10/20 coins in terms of market cap and has an APY (annual percentage yield) of 13-16% since its inception, making it one of the most profitable stakable assets since 2020.

-

Low risk, high yield

Compared to other blockchains, there is a low risk of slashing when staking DOT. The main risk is missing out on staking rewards in case of poor validator performance which is statistical and should be linearised over time.

Ledger is partnering with Figment to offer an institutional-grade Polkadot staking service.

-

A unique automated staking

Polkadot is a blockchain that necessitates regular action from the token holder to nominate validators and maximise the rewards one can get. The unique partnership between Ledger and Figment allows us to automate the most cumbersome part of staking with Polkadot giving our user the assurance that we will have a reduced risk of not getting rewards and freeing them valuable time.

How does it work?

Understanding the different Polkadot staking balances

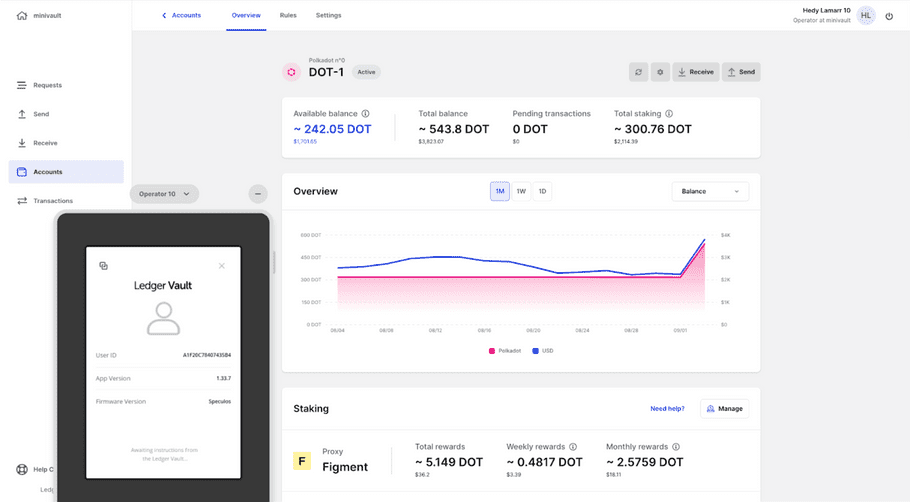

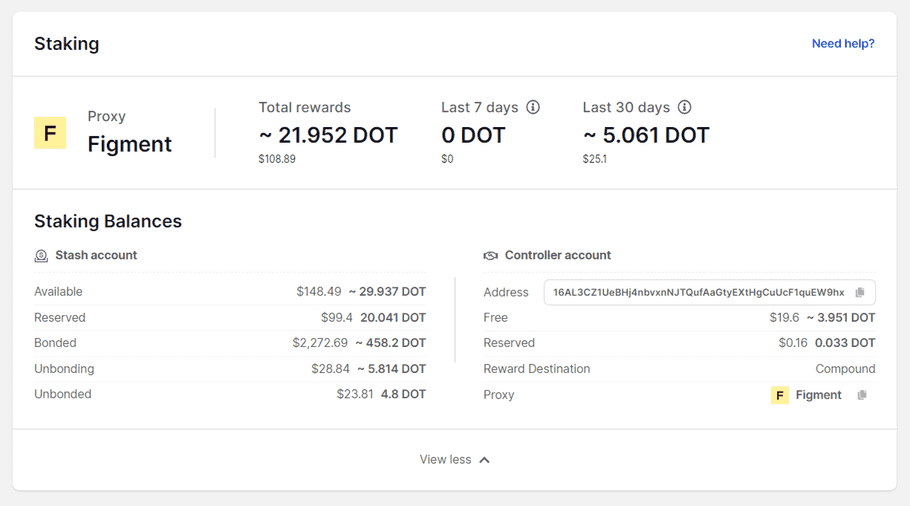

Before diving into the step-by-step instructions on how to earn polkadot staking rewards, we will detail the different balances that exist in the polkadot ecosystem. This is the balances display you'll see on your account page after activating the staking feature on the account.

Staking balances

- Stash account : The Stash Account is the term used by the Polkadot network to speak about your main account that will hold rights over your secondary account, which will be the one which actually performs the staking actions.

- Available : This represents the spendable balance of the account. On the blockchain it is identified as the free balance to which we subtracted 1 DOT, which is the existential deposit to avoid any mismanagement by the user.

- Bonded : This represents the balance that can participate in the governance of the network and generate rewards after the nomination process of validators. The nomination process of validators is done by our partner to avoid for the user to have to do the nomination process every day.

- Unbonding : This represents the total balance of all assets that are in the unlocking period of 28 days. Each time you do an unbond transaction of a specific amount, it will create a new row of unbonding assets in the Staking Positions table.

- Unbonded : This represents the balance of assets that has gone through the 28 days unlocking period and that is now waiting for you to either withdraw them to your available balance or rebond them to your bonded balance.

Controller account balances

- Controller account : The controller account is an account that is identified by a Stash account as its staking management account.

- Address : This is the address of your controller account that has been fetched on the blockchain looking at the responses payload of the Create anonymous sub-account (AKA create controller account) function you previously executed. This address is guaranteed by the blockchain to only be accessible by your stash account.

- Free : This represents the free balance of the account. It is advised to put only 1 DOT on that account to activate it on the blockchain. When you add a proxy partner 0.008 DOT is sent from that balance to the reserved balance of the controller account.

- Reserved : This represents how much has been locked for the lifetime of the proxy you just created. The use of a proxy implies you to lock 20.033 DOT + 0.008 DOT (per proxy). These can be redeemed with the function remove proxy .

-

Reward Destination

: This indicates where your rewards will be sent to by the validator. You can change that destination with the

change rewards destination

function and choose between:

- Cash In - your rewards will go to the available balance of your stash account

- Compounding - your rewards will go to the bonded balance of your stash account and generate rewards in the next round.

- Proxy : It indicates the address chosen as a proxy.

If you created your account before the 4.30 release (1 October 2023) please look at this page for reference.

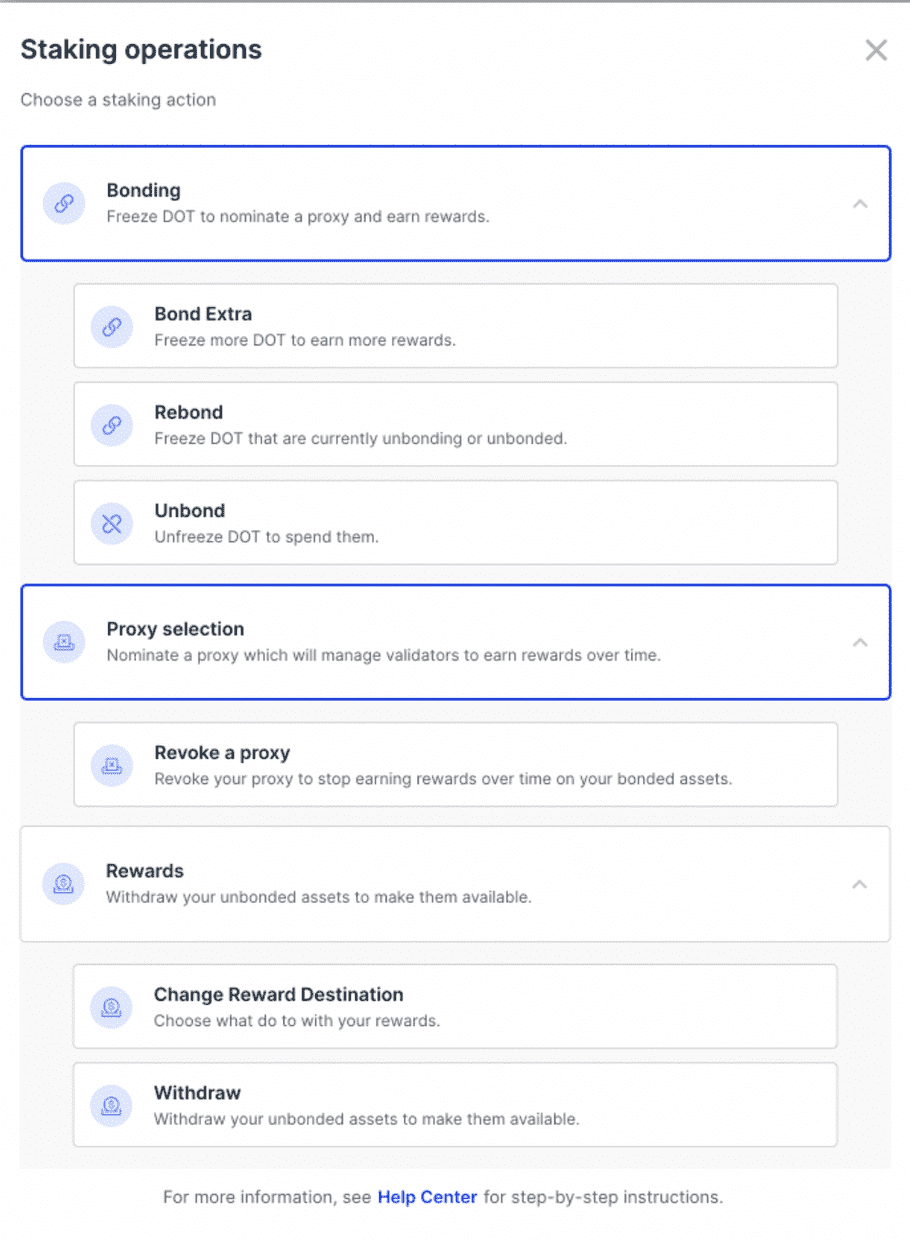

Overview of the different staking operations on Polkadot

Polkadot Staking introduces several actions that need to be performed by the user to be able to do staking. Below is the detailed explanation of what they mean and why they are important.

You can access the Staking Actions if you are in the Staking rules by clicking the Manage button in the Staking section as shown below after you’ve completed Step 3 of the Basic Flow - Bond Asset.

Staking actions

- Bond : act of bonding your first asset, this action identifies the account you’ll lock funds to and identifies it as your controller account. It also identifies the payee of your staking rewards. The two options for payer are Cash In - rewards go to your free balance - and Compounding - rewards go to your bonded balance. You’ll be able to change the payee by using the Change Rewards Destination function. This action is only accessible during the set-up of your staking account.

- Bond Extra : to add more funds to your bonded balance.

- Unbond : to start the process of getting back the bonded asset to the free balance of the stash account . Once you’ve started unbonding assets you must wait 28 days before being able to withdraw them. You can choose to rebond them at any given time.

- Add Proxy Partner : once you have a sufficient bonded balance, you can add a proxy partner that will automatically nominate for you a set of validators regularly in an optimised way. This will allow you to start earning rewards based on your bonded balance.

- Revoke Proxy Partner : you can revoke your proxy at any time, and stop earning rewards.

- Change Rewards Destination : to change the rewards destination of your controller account between Cash In - rewards go to your free balance - and Compounding - rewards go to your bonded balance. When validating on your PSD, we use the polkadot term for Cash in and Compound ; Compound = Staked , Cash In = Stash .

- Chill : as stated on the Polkadot network website, "staking bonds can be in any of the three states: validating, nominating, or chilled (neither validating nor nominating)". Choosing to "chill" your stake means that your funds will stay bonded but won't be delegated and so won't be receiving rewards.

- Withdraw : transfers all your unbonded balance to your free balance, which is displayed as your available balance on the Vault account page.